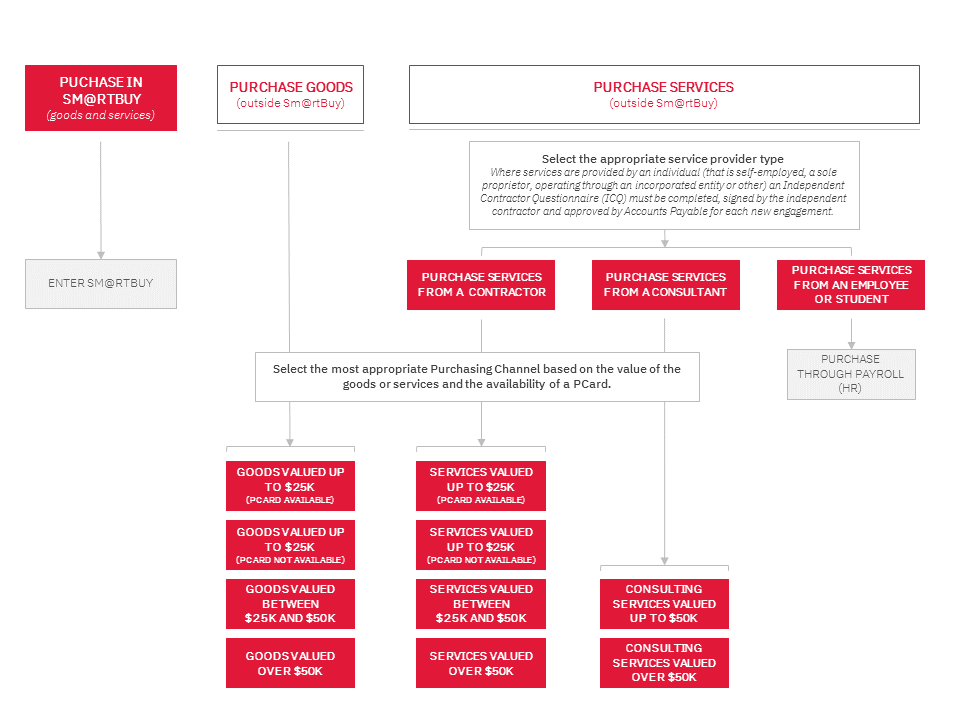

Faculty and staff can purchase goods and services in a number of ways. These 'Purchasing Channels' are designed to make it as easy as possible to purchase goods and services while managing risk and meeting our legal and compliance requirements. For instructions on how to purchase goods or services at York, select the most appropriate purchasing channel below.

Purchasing Channels

Sm@rtBuy is the preferred channel for purchasing goods and services at York.

Learn more about purchasing in Sm@rtBuy.

This channel should be used to purchase goods and services outside of Sm@rtBuy.

As of March 11, 2024, all new purchasing requisitions will need to be submitted through Sm@rtBuy, as paper/PDF requests emailed to purchase@yorku.ca will no longer be accepted. More information on the Purchase Requisition to Purchase Order process can be found here.

Purchases exempt from procurement policy and procedure

The transactions listed below are not managed by Strategic Procurement Services. Please follow the links provided to learn more about completing these types of transactions.

How to reach us

4747 Keele Street Unit 1

Toronto, ON M3J2N9

Office Hours:

Monday to Friday

8:30AM - 4:30PM